Unbanked by choice?

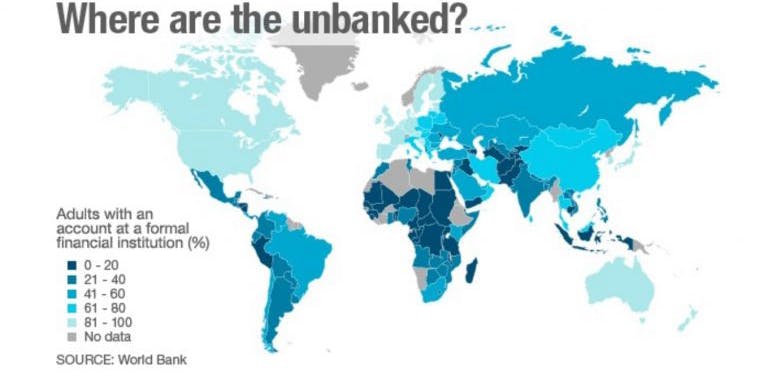

- 60% of Africa’s population (17% of the world’s unbanked) do not participate in the formal banking system.

- Only 35% of Africans (456 million adults of a total population estimated at 1.3 billion) were expected to have a bank account by 2022.

- 40 million Europeans are unbanked, and we can only guess how many are venturing into having a digital identity completely independent of the formal network.

Conventional thinking surmises that the unbanked are being left behind, are too poor, or do not have the knowledge or other resources to participate in the formal banking sector.

Or, is it perhaps because it is simply not worth the hassle?

Traditional banking runs on dated banking models of branch networks, expensive technology, inadequate systems and a limited talent pool. In the aftermath of a global financial crisis and the covid pandemic, the promise that “formal financial services can help people to protect their earnings, and participate in economic activities” is losing its appeal.

Could it be that poor people knew this all along, and the rest of us are only now catching up?

The adoption of cryptocurrency infrastructure is driven by perceived failings of traditional financial systems and distrust in governments. Mistrust and governance issues aside, microbusiness and informal markets don’t want to be hamstrung by bureaucracy. South Africa, Kenya and Nigeria are in the top 10 countries of highest grassroots crypto adoption in the world.

The sluggish, inefficient and not customer-minded banking sector may be a tolerable inconvenience for higher earners, but it is simply not good enough for the micro-enterprises making up the bulk of Sub-Saharan Africa’s economic activity.

Supported by design

Innovation in banking services is not necessarily choosing between the traditional banking system or the emerging and currently poorly regulated crypto scene. Can formal banking improve, be more accommodating to their clients’ needs? Improved service targeting the lower income brackets include updating their technology and infrastructure systems, and updating their KYC requirements to be less burdensome. This may mean introducing smart contracts, digital assets and the efficiencies of technologies currently associated with crypto. If they don’t, more and more people will take the risk on crypto.

At the same time, regulators need to be more open minded and embracing of the efficiencies and economic benefits of DeFi’s fast, pseudonomous, borderless payments starting with lower amounts or lower risk areas.

Over the past year, a record number of new accounts have been opened worldwide by firms providing mobile money, fintech and online banking services. Following the pandemic, more people are leaving the formal economy. Crypto makes it possible and more efficient. Two aspects are catalysts to this migration: Peer to peer (P2P) platforms and layer two technologies.

P2P platforms are essential to service adoption in developing countries and are particularly suited to unbanked individuals. P2P platforms don’t custody any of the digital assets or fiat traded on their platforms, negating the need to connect to the banking system and comply with strenuous regulatory hurdles. This allows them to onboard residents of developing countries more easily, many of whom are excluded from the traditional financial ecosystem.

Layer two technologies are ‘off-chain’ protocols that do not record every single transaction on the bitcoin blockchain. These protocols, like the Lightning network, are effectively independent of the value of Bitcoin thus avoiding the risk of the crypto volatility. In short, layer two technologies enable very cheap, very fast transactions.

It would be prudent for African banks and governments to catch up with this runaway train of a more efficient mechanism of decentralised, borderless money as a store of value and medium of exchange. Embracing these new monetary technologies can give Africa and Africans a global competitive advantage. The genie is out of the bottle.

Further reading:

www.gfmag.com

www.paymentscardsandmobile.com

www.elixirr.com

www.wsbi-esbg.org

repository.uel.ac.uk

link.springer.com

go.chainalysis.com

About the authors

This thought piece, the second in the series, was written as part of Robin Philip’s Masters research in Digital Currency, to update his 20 years experience in online payments. As co-founder of African Payment Solutions, a pan-African eCommerce payments company for multinational eCommerce merchants, he is considering how to best serve clients in the rapidly evolving future of ecommerce.

Bernelle Verster is trained as a bioprocess engineer, and recently changed gear to explore 3D geospatial and data visualisation, with great excitement for the metaverse. Her interest is in interfaces, the spaces between: How do we transition responsibly to a decentralised … more democratic?, more digital way of doing things? How does that link back to the physical world? How do we empower people who have thus far been excluded from the dominant economic forces?